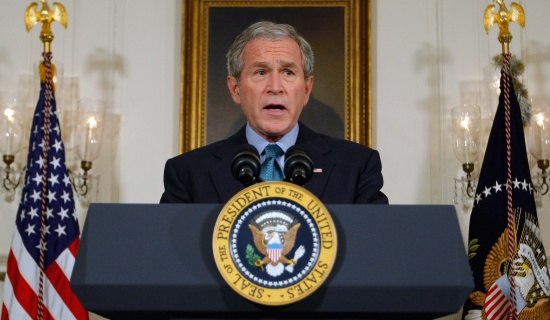

Bush urges Congress to pass bailout

IHT

30 Settembre 2008

WASHINGTON: President George W. Bush urged lawmakers again on Tuesday to quickly approve an economic bailout plan, a day after the House rejected a $700 billion proposal that the White House had negotiated with congressional leaders of both parties. Though financial markets around the world plunged after the rejection, but the American markets rebound Tuesday with both the Dow Jones industrial average and the Standard & Poor's 500-stock index up more than 2.2 percent. The Dow was up 235 points after about 15 minutes of trading.

The action in the markets reflected optimism that Congress may still act this week to approve an economic rescue plan, after the House's defiance of the president and party leaders left lawmakers groping for a resolution.

Bush said on Tuesday that his administration would talk with congressional leaders again, so that Congress could begin "moving legislation forward when members begin returning to the Capitol" on Wednesday, after the Jewish New Year.

Acknowledging that the vote on the plan was "difficult" for some members of Congress, Bush said the cost of failing to ultimately pass the measure would be far higher than the cost of the bailout.

"We are at a critical moment for our economy," he said, adding, "Congress must act."

As he had on Monday, Bush said on Tuesday that he was confident that an agreement would be reached.

"I am disappointed by the outcome, but I assure our citizens and citizens around the world that this is not the end of the legislative process," Bush said.

Henk Potts, equity strategist at Barclays Wealth in London, said, "The market's disappointed — shocked even — by what happened in Washington, but there's still an expectation that a deal will be done."

The stunning defeat of the proposal on a 228-205 vote, after marathon talks by senior congressional and Bush administration officials on Monday, lowered a fog of uncertainty over economies around the globe. Its authors had described the measure as essential to preventing widespread economic calamity.

Frédéric Rozier, at Meeschaert, an asset manager in Paris, said the market there was also heartened on Tuesday by the gains in American stock futures, and he cited a "technical rebound" after the aggressive sales of recent days had touched off some automatic buying.

Futures on the Standard & Poor's 500 Index added 2.5 percent on Tuesday, retracing some of the index's 8 percent loss on Monday.

The Dow Jones Euro Stoxx 50 Index, a benchmark for the euro region, shed 0.3 percent, falling to 2,999.75 points in early trading on Tuesday. The CAC-40 was up 0.3 percent in Paris, the German DAX was off 0.9 percent and the FTSE-100 in London gained 0.2 percent.

Asian stocks trimmed some losses in afternoon trading after plunging at the open. In Tokyo, Asia's largest market, the Nikkei 225 fell 4.1 percent to close at a three-year low of 11,259.86 points. The benchmark index in Hong Kong closed up by less than 1 percent, while Australia ended down almost 4.4 percent after falling more than 5 percent during the morning.

In the U.S. on Monday, the markets began to plummet even before the 15-minute voting period expired on the House floor. For 25 more minutes, uncertainty gripped the nation as television showed party leaders trying, and failing, to muster more support. Finally, Representative Ellen Tauscher, Democrat of California, pounded the gavel and it was done.

In the end, only 65 Republicans — just one-third of those voting — backed the plan despite personal pleas from Bush and encouragement from their presidential nominee, Senator John McCain. By contrast, 140 Democrats, or 60 percent, voted in favor, many after voicing grave misgivings. Their nominee, Senator Barack Obama, also backed the bill.

By the end of day, the Dow had fallen almost 778 points, or nearly 7 percent, to 10,365. Credit markets also remained distressed, with bank lending rates rising and investors fleeing to the safety of Treasury bills.

Among opponents of the rescue plan, some Republicans cited ideological objections to government intervention, and liberal Democrats said they were of no mind to race to aid Wall Street tycoons. Other critics complained about haste and secrecy in assembling the plan.

But lawmakers on both sides pointed to an outpouring of opposition from deeply hostile constituents just five weeks before every seat in the House was up for election as a fundamental reason that the measure was defeated. House members in potentially tough races and those seeking Senate seats fled from the plan in droves.

"People's re-elections played into this to a much greater degree than I would have imagined," said Representative Deborah Pryce of Ohio, a former member of the Republican leadership who is retiring this year and voted for the plan. Congressional leaders in both parties said they did not know how they would proceed but were examining options, including having the Senate, where there was more support for the bailout, advance a bill after the Jewish New Year on Tuesday. Congressional leaders said any doubt about the need for action should have been removed by the market fall.

"We're not leaving town till we get it fixed," said Senator Mitch McConnell of Kentucky, the Republican leader.

At the White House on Monday, Bush met with his economic advisers as well as the Federal Reserve chairman, Ben Bernanke, to discuss next steps. "I was disappointed in the vote," Bush said, appearing in the Oval Office with President Viktor Yushchenko of Ukraine. "Our strategy is to continue to address this economic situation head on."

The Treasury secretary, Henry Paulson Jr., who was the main architect of the financial rescue plan, said he would continue to work with congressional leaders "to find a way forward to pass a comprehensive plan to stabilize our financial system and protect the American people." He added, "This is much too important to simply let fail."

McCain and Obama renewed their calls for swift action, though each campaign sought to partly blame the other for the defeat.

At the Capitol, Democrats accused Republicans of failing to deliver enough number of votes. "Sixty-seven percent of the Republican Conference decided to put political ideology ahead of the best interest of our great nation," the Democratic whip, Representative James Clyburn of South Carolina, said after the vote.

Representative Roy Blunt of Missouri, the Republican whip, said that before the vote he had tallied 75 votes in his conference in favor of the plan. By the time the votes were cast, the Republicans could deliver only 65 of them.

Other top Republicans pointed at what they saw as a partisan speech by Speaker Nancy Pelosi in advance of the vote as a factor — a charge Democrats derided.

Republicans said they had alerted Democrats they might not have the numbers required. But they never recommended the legislation be put off and in the end they were unable to win any last-second converts to change the votes that would have been necessary to turn defeat into victory.

Representative John Boehner of Ohio, the House Republican leader, said he tried repeatedly and unsuccessfully to sway a handful of holdouts, but eventually gave up.

"You can't break their arms, you can't put your whole relationship on the line with them and ask them to do something they do not want to do and have that member regret that vote for the rest of their life," said Boehner, who said he could not remember a time when the muscle of both parties and the White House failed to produce a victory.

The outcome after a slightly more than 40-minute vote on the House floor left lawmakers almost speechless. Even the strongest opponents of the measure did not expect to prevail, and the leadership of both parties, while increasingly nervous, figured they would squeak out a victory despite a parade of Republicans and Democrats to microphones to assail the measure. At the White House, the deputy press secretary, Tony Fratto, said just before the vote: "We're confident that it will pass."

Under the proposal, the Treasury Department could tap up to $700 billion in taxpayer money in installments to buy troubled debt from financial firms, in the hopes of freeing up credit to fuel normal economic activity.

In the final stages of negotiations, new provisions intended to recoup taxpayer losses were added. They helped the measure win support from Boehner and some other House Republican leaders, who had strongly opposed an earlier version of the bill. But they did not put the package over the top.

In impassioned speeches on the House floor, Democrats and Republicans alike vented their frustration over the nation's perilous economic condition and the uncomfortable position they were in, facing pressure to approve an unpopular bailout package during an election year, with no guarantee that it would work.

"This is a huge cow patty with a piece of marshmallow stuck in the middle of it and I am not going to eat that cow patty," said Representative Paul Broun, Republican of Georgia.

"Nobody wants to do this," said Representative Edward Markey, Democrat of Massachusetts, who nonetheless voted for it. "Nobody wants to clean up the mess created by Wall Street recklessness."

In the speech that Republicans said infuriated them, Pelosi accused Bush of squandering the budget surpluses of the Clinton years. "They claim to be free-market advocates, when it's really an anything-goes mentality," she said. "No supervision. No discipline. And if you fail, you will have a golden parachute and the taxpayer will bail you out."

Democrats later said that if her speech truly cost votes, then Republicans, in the words of Representative Barney Frank, Democrat of Massachusetts, were guilty of punishing the country because Pelosi had hurt their feelings.

As the voting time expired on the floor, party leaders realized they were coming up far short. At 1:49 p.m., it was 205 for and 228 against. At 1:54 p.m., they inched closer: 207 to 226, as some representatives changed their votes. What followed was a remarkable stalemate on the House floor, with top lieutenants in both parties clutching lists of votes, as they clustered in the well and made unusual forays into what is normally enemy territory across the aisle.

"I was asking where the hell their votes were," said Representative Rahm Emanuel of Illinois, the No. 4 Democrat.

Blunt said he told Democrats he thought he could flip five votes, if Democrats could do the same. Democrats had warned that the Republicans that they would need to produce 80 to 100 votes to adopt an unpopular plan championed by the Republican White House. Ultimately, the Democrats decided the votes were not there and they allowed the gavel to come down. Opponents of the measure said they expected the administration and congressional leaders to try again on a rescue proposal and were not worried about being held responsible for the stock decline or other economic uncertainty.

"I think we will be back in a couple of days with a proposal more palatable to more members," said Representative John Yarmuth, a Kentucky Democrat who voted against the plan. "You don't make the biggest financial decision in the history of this country in a few days' time without hearings."

But Representative Tom Davis, a Virginia Republican who is retiring from Congress and who backed the proposal, said those who opposed to the measure might be hearing a different message from their voters if economic conditions worsen. "The members who voted no will have some culpability," he said.

The House leadership said Monday night that the House would reconvene at noon Thursday, though it was not known if another economic plan would be on the table.

"Stay tuned," said Pelosi, who seemed physically drained. But she added: "What happened today cannot stand. We must move forward, and I hope that the markets will take that message."

Representative Greg Walden, an Oregon Republican who supported the bailout, said lawmakers may quickly discover "whether this is as dire a situation as we were told."

"This is playing with fire," Walden said. "It's very, very dangerous."

David Herszenhorn, Martin Fackler, Robert Pear, Steven Lee Myers, Sheryl Gay Stolberg and Graham Bowley contributed reporting

Source > IHT.com | sept 30